Forex trading, also called foreign exchange trading, requires the getting and selling of currencies on the foreign change market with the goal of earning a profit. It’s the greatest financial market globally, by having an normal everyday trading size exceeding $6 trillion. Forex trading offers investors and traders the ability to suppose on the fluctuation of currency prices, permitting them to perhaps benefit from changes in trade prices between various currencies.

One of many important options that come with forex trading is their decentralized character, as it runs twenty four hours each day, five times weekly across different time zones worldwide. That convenience allows traders to participate on the market at any time, providing ample opportunities for trading across the clock. Moreover, the forex market is extremely water, meaning that currencies are available and sold quickly and easily without somewhat affecting their prices.

Forex trading involves the utilization of power, allowing traders to control larger positions with a lesser amount of of capital. While influence can boost profits, in addition it raises the danger of failures, as even little changes in currency rates can lead to significant gains or losses. Therefore, it’s required for traders to control their risk carefully and use proper risk administration methods, such as placing stop-loss requests and diversifying their trading portfolio.

Moreover, forex trading provides a wide selection of trading methods and practices, including specialized analysis, essential examination, and sentiment analysis. Technical analysis involves understanding traditional cost knowledge and applying different indications and graph designs to identify tendencies and anticipate future price movements. Elementary examination, on the other hand, is targeted on studying financial indications, information functions, and geopolitical developments to gauge the intrinsic price of currencies. Feeling analysis requires assessing market sentiment and investor conduct to foresee adjustments in industry sentiment.

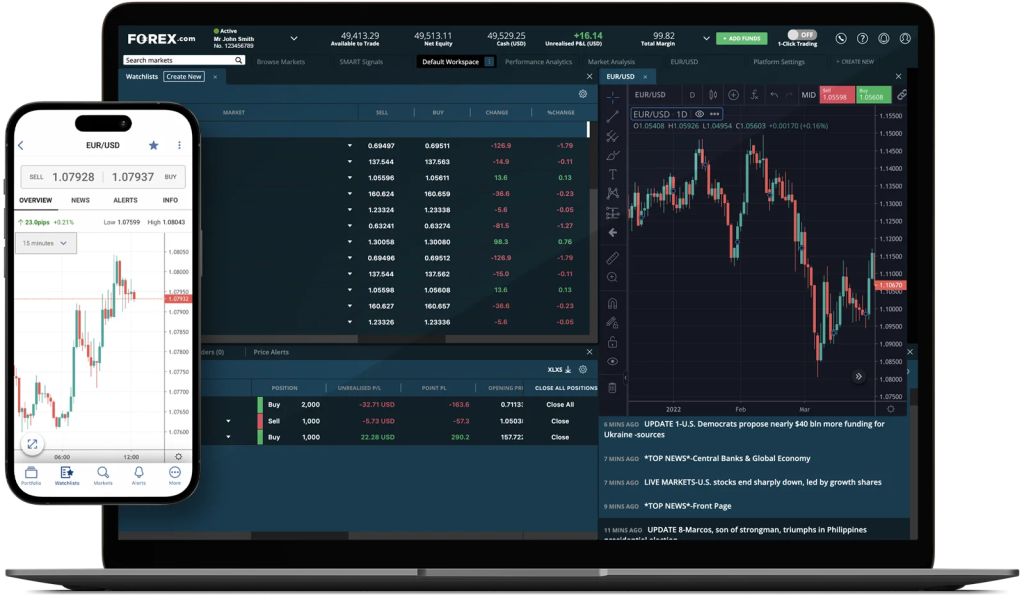

More over, advancements in technology have altered the landscape of forex trading, rendering it more accessible and efficient than ever before. On the web trading platforms and portable programs let traders to accomplish trades, entry real-time industry knowledge, and check their roles from anywhere with a net connection. Also, automated trading programs, such as for instance specialist advisors (EAs) and trading robots, can implement trades quickly predicated on pre-defined criteria, removing the need for guide intervention.

Despite its prospect of gain, forex trading carries natural risks, and traders must be familiar with the issues and issues associated with the market. Volatility, geopolitical functions, and unexpected market actions may cause significant deficits, and traders should forex robot anticipate to manage these risks accordingly. Moreover, cons and fraudulent activities are common in the forex industry, and traders should exercise caution when selecting a broker or investment firm.

In summary, forex trading provides a energetic and probably lucrative chance for investors and traders to take part in the global currency markets. With its decentralized character, high liquidity, and accessibility, forex trading is now significantly popular among persons seeking to diversify their expense portfolio and capitalize on currency value movements. But, it’s required for traders to teach themselves about the marketplace, develop a stable trading approach, and training disciplined risk administration to flourish in forex trading on the long term.